Step-by-Step Guide for Completing Your Tax Refund in Australia

Understanding the Relevance of an Income Tax Return: Exactly How It Affects Your Financial Future

Recognizing the value of a Tax return extends beyond mere compliance; it functions as an essential tool in forming your monetary trajectory. A complete income tax return can influence crucial decisions, such as lending qualification and prospective savings using credits and reductions. Furthermore, it uses insights that can purposefully notify your financial investment options. However, lots of individuals undervalue the implications of their tax obligation filings, typically overlooking the wealth-building possibilities they present. This raises crucial questions regarding the more comprehensive impact of tax obligation returns on lasting financial stability and preparation. What might you be missing?

Summary of Income Tax Return

Tax obligation returns are crucial records that organizations and people submit with tax obligation authorities to report earnings, expenditures, and various other monetary information for a specific tax year. These extensive forms offer numerous objectives, consisting of identifying tax responsibilities, asserting reductions, and assessing eligibility for various tax obligation credit scores. The primary elements of an income tax return usually include income from all resources, changes to earnings, and a comprehensive breakdown of reductions and debts that can minimize general taxable revenue.

For individuals, common kinds include the IRS Kind 1040 in the United States, which outlines earnings, passion, returns, and other kinds of income. Businesses, on the various other hand, may make use of the internal revenue service Form 1120 or 1065, relying on their structure, to report business earnings and expenditures.

Submitting tax returns accurately and prompt is essential, as it not just guarantees compliance with tax obligation legislations yet likewise influences future monetary preparation. A well-prepared tax return can provide insights into financial wellness, highlight locations for potential cost savings, and facilitate educated decision-making for both individuals and services. The complexities included necessitate an extensive understanding of the tax code, making professional assistance frequently helpful.

Influence on Finance Eligibility

Prompt and accurate entry of tax obligation returns plays a necessary duty in establishing a person's or business's eligibility for car loans. Lenders commonly call for current income tax return as component of their assessment procedure, as they provide a comprehensive summary of earnings, financial stability, and overall financial wellness. This documents aids lending institutions gauge the consumer's capacity to settle the financing.

For people, constant earnings reported on income tax return can enhance creditworthiness, leading to much more beneficial car loan terms. Lenders generally look for a secure revenue history, as fluctuating earnings can elevate worries about payment capacity. Similarly, for organizations, tax obligation returns serve as a significant indication of success and cash circulation, which are vital elements in safeguarding service finances.

Moreover, discrepancies or mistakes in tax obligation returns may elevate red flags for lending institutions, potentially leading to lending rejection. Therefore, maintaining precise documents and filing returns in a timely manner is important for companies and people aiming to enhance their financing eligibility. In conclusion, a well-prepared tax return is not just a legal requirement however additionally a strategic tool in leveraging monetary opportunities, making it essential for any person thinking about a financing.

Tax Obligation Credits and Deductions

Recognizing the subtleties of tax obligation credit scores and deductions is vital for enhancing monetary results. Tax obligation credit scores straight lower the quantity of tax obligation owed, while reductions lower taxable income. This distinction is significant; for example, a $1,000 tax obligation credit rating decreases your tax obligation costs by $1,000, whereas a $1,000 reduction minimizes your gross income by that amount, which causes a smaller sized tax reduction depending on your tax obligation brace.

Reductions, on the various other hand, can be detailed or taken as a conventional reduction. Making a list of permits taxpayers to list eligible expenditures such as mortgage rate of interest and clinical costs, whereas the common reduction offers a fixed reduction amount based upon declaring status.

Preparation for Future Investments

Reliable planning for future investments is vital for building wealth and accomplishing economic goals. A well-structured financial investment approach can help individuals utilize on possible development opportunities while also reducing dangers linked with market variations. Recognizing your income tax return is an important element of this planning process, as it supplies understanding right into your monetary wellness and tax obligation commitments.

Furthermore, knowing how financial investments might influence your tax situation allows you to choose investment vehicles that straighten with your general financial approach. Prioritizing tax-efficient investments, such as lasting funding gains or municipal bonds, can improve your after-tax returns.

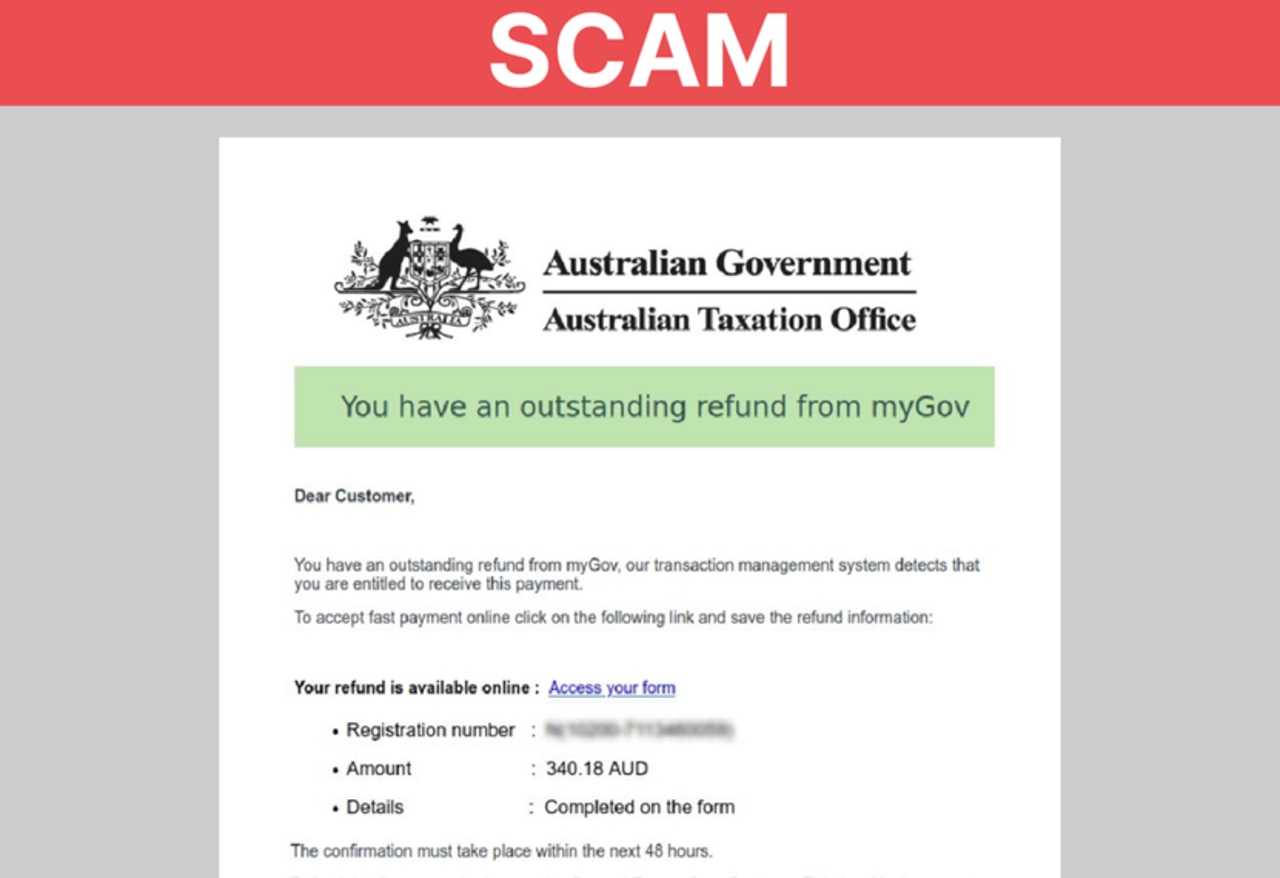

Common Tax Obligation Return Myths

Many people hold misunderstandings about income tax return that can lead to complication and costly blunders. One prevalent misconception is that filing an income tax return is only needed for those with a significant revenue. Actually, also individuals with reduced earnings may be called for to submit, especially if they get approved for specific credits or have self-employment income.

Another typical misconception is the idea that obtaining a refund indicates no taxes are owed. While refunds suggest overpayment, they do not discharge one from liability if tax obligations schedule - Online tax return. Additionally, some believe that tax obligation returns are only essential throughout tax period; however, they play an important duty in monetary preparation throughout the year, impacting credit rating and car loan eligibility

Several likewise think that if they can not pay their tax obligation bill, they must prevent declaring altogether. This can bring about penalties and passion, aggravating the issue. Lastly, some think that tax prep work software program guarantees precision. While useful, it is necessary for taxpayers to comprehend their special tax situation and review entries to confirm compliance.

Dispelling these myths is essential for effective economic administration and preventing unnecessary complications.

Verdict

To summarize, income tax return function as a basic element of financial monitoring, affecting finance eligibility, uncovering potential financial savings with deductions and credit ratings, and educating calculated investment choices. Ignoring the importance of exact tax return declaring can result in missed out on monetary Australian tax refund possibilities and impede efficient monetary planning. As a result, an all-encompassing understanding of income tax return is important for cultivating long-term economic stability and enhancing wealth-building strategies. Prioritizing tax obligation return awareness can substantially enhance general economic health and wellness and future leads.

Tax obligation returns are vital files that individuals and organizations file with tax authorities to report income, expenses, and other economic details for a specific tax year.Filing tax returns accurately and timely is vital, as it not only guarantees compliance with tax obligation regulations yet additionally influences future economic preparation. Nonrefundable credit scores can only reduce your tax responsibility to absolutely no, while refundable credit ratings may result in a Tax reimbursement exceeding your tax owed. Usual tax obligation credit scores include the Earned Revenue Tax Obligation Credit Scores and the Child Tax Obligation Credit, both intended at sustaining family members and people.

Additionally, some think that tax obligation returns are only vital during tax obligation season; however, they play a vital duty in monetary planning throughout the year, influencing debt ratings and funding eligibility.